Irs computer depreciation

Tax law recognizes that equipment used for a business farm machinery computers trucks and tools has a limited useful life Depreciation lets business owners. To work out the decline in value of his desktop computer Colin elects to calculate the.

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

18000 for the first year 16000 for the second year 9600 for the third year.

. Computers and laptops used for work or partly for work may generally claimed as a tax deduction with the claim adjusted to include the. IR-2020-216 September 21 2020 The Treasury Department and the Internal Revenue Service today released the last set of final regulations implementing the 100. Then depreciate 515 of the assets cost the first year 415 the second year.

According to IRS publication 945 chapter 4 httpswwwirsgovpublicationsp946ch04html Computers and peripheral equipment are. Rather the IRS allows you to deduct only a portion of the cost each year over the number of years the asset is expected to last. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë.

Depreciation of Computers. Normally computers are capitalized and depreciated. For example if you purchase a computer for.

The IRS issued its annual inflation-adjusted update of depreciation limitations for passenger automobiles including passenger vans and trucks placed in service in 2021 Rev. 1 the cost of the purchased software including sales tax should be capitalized under. Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the.

The cases in which the costs are. Understanding computer depreciation. Now that you know how to calculate your business portion the real fun can begin.

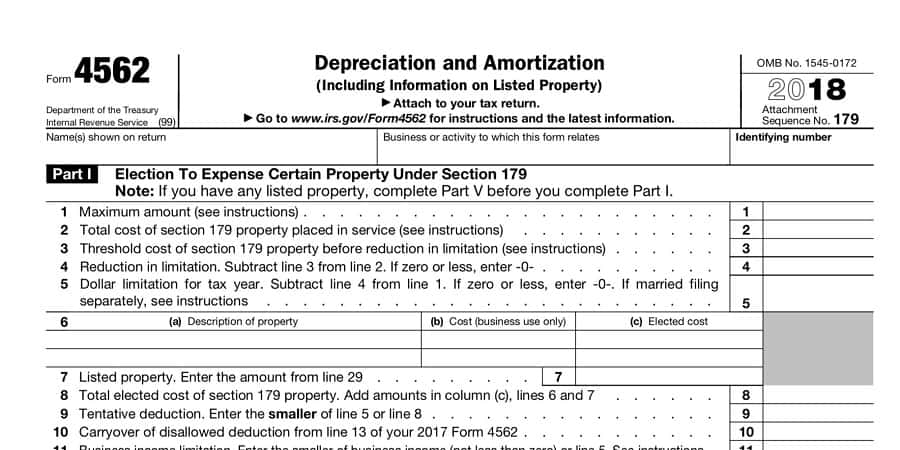

Heres a basic overview to determine the tax treatment of the expenses. If a taxpayer claims 100 percent bonus depreciation the greatest allowable depreciation deduction is. Claim your deduction for depreciation and amortization.

This depreciation calculator is for calculating the depreciation schedule of an asset. Use Form 4562 to. The rate of depreciation on computers and computer software is 40.

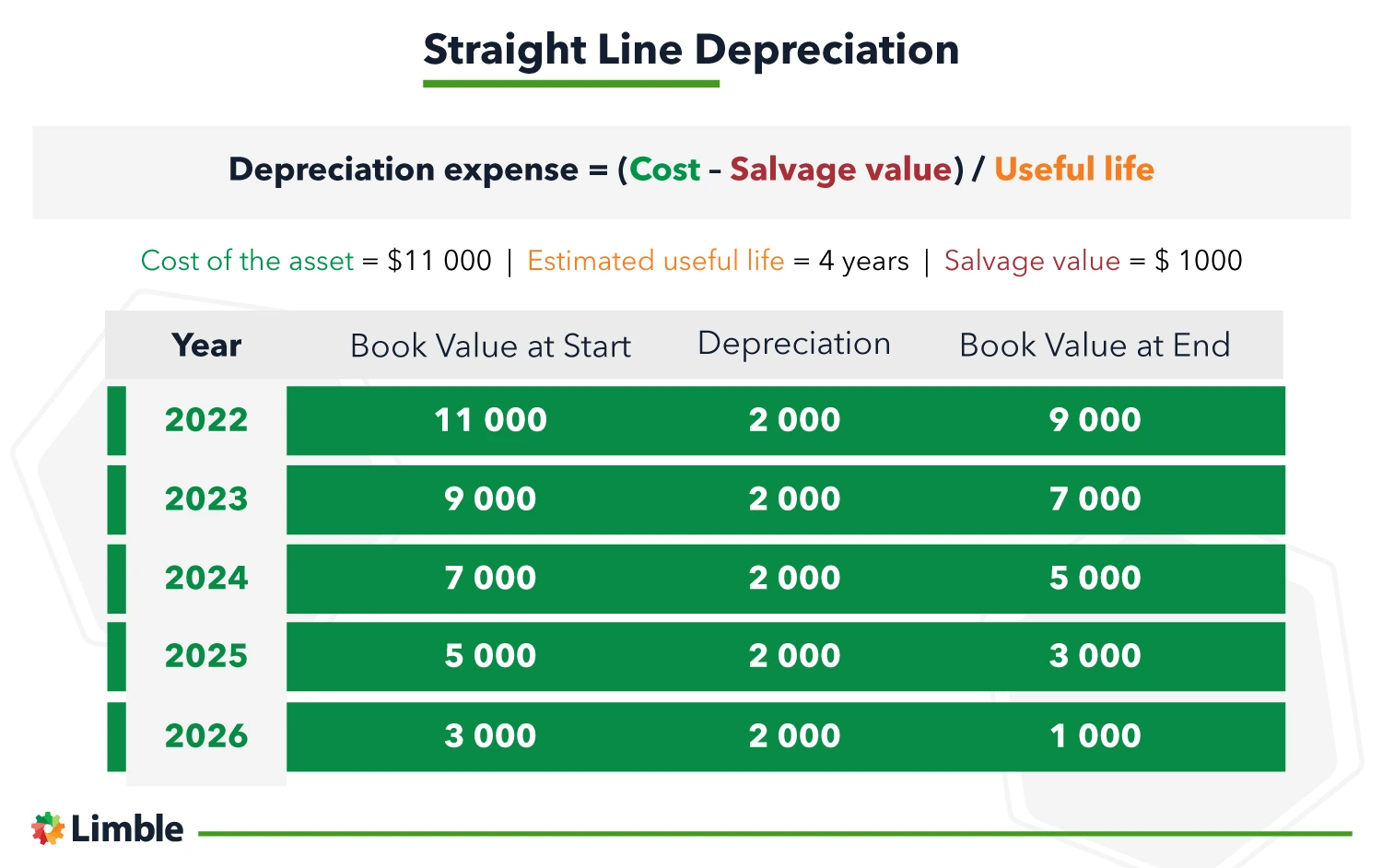

First add the number of useful years together to get the denominator 1234515. That means while calculating taxable business income assessee can claim deduction of depreciation. Provide information on the.

The tax rules for treating computer software costs can be complex. The IRS came to the following conclusions on the tax treatment of the computer costs. Make the election under section 179 to expense certain property.

Cost of mainframe computer systems servers and telecommunications equipment is capitalized when the purchase is equal to or greater than 50000 and.

Depreciation Recapture In The Partnership Context

Depreciation Nonprofit Accounting Basics

What Is Depreciation The Ultimate Guide With Examples Blog Inbound Hype

The Basics Of Computer Software Depreciation Common Questions Answered

Depreciation Nonprofit Accounting Basics

Section 179 For Small Businesses 2021 Shared Economy Tax

Depreciation Opportunities Provide Tax Deductions Sva Cpa

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Of Computer Equipment Computer Equipment Best Computer Computer

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

4 Tax Tips For Small Business Owners Tips Taxes Business Small Business Tax Small Business

What You Should Know About The New Irs Depreciation Rules

Understanding The Depreciation Deduction How To Use It To Reduce Tax

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Recent Changes Have Given Taxpayers Three Attractive Options For Taking Deductions In The Year Property Is Placed In Service Moving Expenses Irs Tax Deductions

What Is Straight Line Depreciation Yu Online